Mental Health and Insurance in Singapore

- AgentMamaSG

- Mar 7, 2021

- 6 min read

You are in the prime of your life. You are happily married, have beautiful children, a great career, many wonderful friends and everything seems picture perfect. Except it is not. That smile that you put on hides so many things. You have it all but still, sometimes you feel like you have nothing at all. And what is worse, there is a feeling that you are alone with no one to talk to or share with. And you just cannot help it no matter how hard you try.

I will be honest. With the circuit breaker last year, there came a time when I broke. I had just given birth a couple of months back and I also had an inquisitive 3-year-old who was just high on life. Being in a career where I would meet many people on a daily basis to having to be stuck at home surrounded by my four walls and a roof over my head made home seem like a prison. Plus, I was even unable to meet my extended family which is a source of my inner strength. The toughest was during Easter where my parents waved at me from the road below my window with my son shouting across to them. That night I cried. Unconsolably.

This pandemic has taken a toll on so many aspects of our lives, including our mental health. There is so much anxiety about the future be it with regards to jobs, the economy, social interaction and more. Many people suffer alone in silence with their thoughts oscillating between good days and bad days. What is worse is that some people may not even realise that what they might be feeling or going through is some sort of mental illness. And yet there are those who feel the need to talk to someone but do not know where to turn to or are deterred due to the exorbitant costs involved in seeking help.

“Health is a state of complete physical, mental and social well-being and not merely the absence of disease or infirmary.”

– World Health Organisation (WHO)

According to a study conducted in 2016, one in seven Singaporeans suffers from either a mood, anxiety or alcohol-use disorder in their lifetime. I am sure that with COVID-19, the numbers are higher. The youth and the elderly make up the majority of the vulnerable groups who are more likely to be associated with mental disorders. The leading cause of death for 10–29-year-olds is suicide. The number of elderly suicides is also reported to be at an all-time high.

Even though there has been more awareness given to mental illness in Singapore, we are still far behind other countries that have systems in place to ensure that people have the proper care and treatment they need. We all know someone who has been diagnosed with a mental illness or is going through treatment. In fact, these days children are also being diagnosed at a younger age due to advanced screening measures in school.

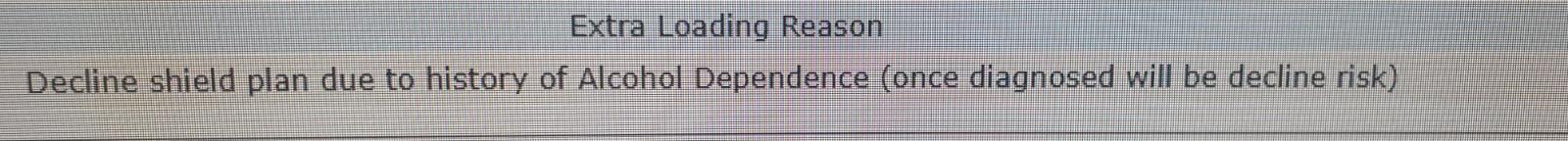

Over the years, I have been approached by many people wanting to take out health insurance for themselves. Some of these people have either battled with or are battling with mental illness. Even if these illnesses were diagnosed many years back or especially if they are still taking medication, the underwriting decision has always come back the same: DECLINED.

In health insurance terms, mental illness (like Depression, Schizophrenia, Eating Disorders, Bipolar Disorder or Substance Abuse e.t.c) is considered a pre-existing condition once you have seen a medical practitioner for it or if you have been diagnosed with it during a specified period of time or if you are currently taking medication for it. Being mentally ill makes one vulnerable. Their condition may affect their lives with some not being able to work or function normally. Fortunately, mental illness is not terminal. Given the proper treatment and care, the mentally ill can integrate back into society.

However, not being able to purchase health insurance might add to their anxiety. On top of that, this anxiety can also be passed onto caregivers who then have to find means both financially and emotionally to support them. Insurance companies exclude certain pre-existing medical conditions to eliminate the possibility of very large pay-outs. But to ban coverage for the mentally ill completely is discriminatory. Mental health is such a grey area with a lot of what-ifs. Unfortunately, for now, insurers in Singapore are choosing to view it as black or white.

The health insurance coverage is not just limited to conditions excluding mental illness. Instead, those with mental illnesses are completely denied ANY coverage at all. The reason being that the illness is considered a pre-existing condition that can be viewed as high risk for self-inflicted harm and thus insurers choose not to cover these individuals. I have even had clients who want to cover their children who have ADHD or Dyslexia being denied coverage completely. This is rather unsettling considering that the child is otherwise functioning normally. And it is not even the fault of the child!

What could be more palatable is perhaps an exclusion clause to anything related to mental issues. Or perhaps even charging a higher premium so that people with mental illness can then be fully insured. It will take time for insurance companies in Singapore to follow their counterparts in America or Europe and allow people with pre-existing conditions to purchase insurance.

In the meantime, here are ways that can help those with mental illness tide through:

1. Medisave

(Medisave may be used for your spouse, children, parents and grandparents (grandparents must be Singapore citizens or permanent residents)

The use of Medisave for inpatient psychiatric treatment is subject to a withdrawal limit of $150 per day and a maximum of $5,000 a year. The use of Medisave for outpatient treatment of schizophrenia, major depression, Bipolar Disorder, Anxiety and Dementia is subject to a 15% co-payment by the patient per claim. In addition, the amount of Medisave withdrawn for the treatment of one or more approved chronic diseases, shall not exceed $500 per Medisave account per calendar year or the remaining balance in the Medisave account holder, whichever is lower.

Medisave does not cover the following:

Outpatient consultation fees, tests and investigations (except for approved chronic disease management diagnosis, e.g., Major Depression, Schizophrenia, Bipolar Disorder, Anxiety and Dementia)

Charges for medical reports

Private expenditures, such as telephone calls

Ambulance fees

Hospital stays for less than 8 hours

Respite care

2. Medishield Life

Before MediShield Life can be applied to cover the hospital bill, one would need to pay a deductible (either through Medisave or cash). The deductible is maintained at $1,500 for C 8-12 bedded wards and $2,000 for B2 4-6 bedded wards to maintain MediShield Life's focus on large bills. In line with the current cost of psychiatric care and to manage the risk of overstaying, the claim limits are pegged at $160 per day, up to 60 days a year. Medishield life now covers attempted suicide, self-harm, substance abuse and alcoholism.

3. Company insurance coverage

There are some company Group Insurance plans that provide a mental wellbeing benefit in the scope of coverage. This is however dependent on each company policy and you should check with HR if your company coverage does indeed have such a cover and how much it will allow you to claim as well.

DID YOU KNOW?

If you purchased your insurances before you developed a mental illness, you could still be covered partially for it. Most Integrated Shield Plans have a provision for Inpatient Psychiatric Treatment with annual limits imposed. Some even have waiting periods before a claim can be admitted.

Should you have a Disability Income Policy, it could also cover you in the event of a mental illness diagnosis. This is subject to a medical practitioner’s report however and you would also be required to review the condition annually whilst in receipt of the monthly benefit. There would also be a deferment period (which you choose at the policy inception) before claims kick in.

However, do note that there are exclusion clauses in policies that prevent you from claiming should it be due to self-inflicted injuries or injuries resulting from attempted suicide.

If you are facing a mental illness and do not know what to do, seek help and support from a mental health professional or talk to your family and friends. The Singapore Association for Mental Health also has a toll-free number to call for counselling (1800 283 7019). Just remember, you are loved and there is hope. Stay safe and be well.

If you have any insurance-related questions, I am here to help. Drop me a message using the contact box below and I will be happy to help. 😊

Comments